While traders were sleeping—well, most of them—Aave (AAVE) suddenly ripped 3.5% higher and dragged the broader CoinDesk 20 index out of its Thursday funk. I was about to call it a night, double-checking my cold-wallet passphrases like every paranoid degen, when alerts started pinging. Yeah, the same annoying Telegram ding that makes you wonder if it's alpha or another meme-coin rug.

Here's What Actually Happened

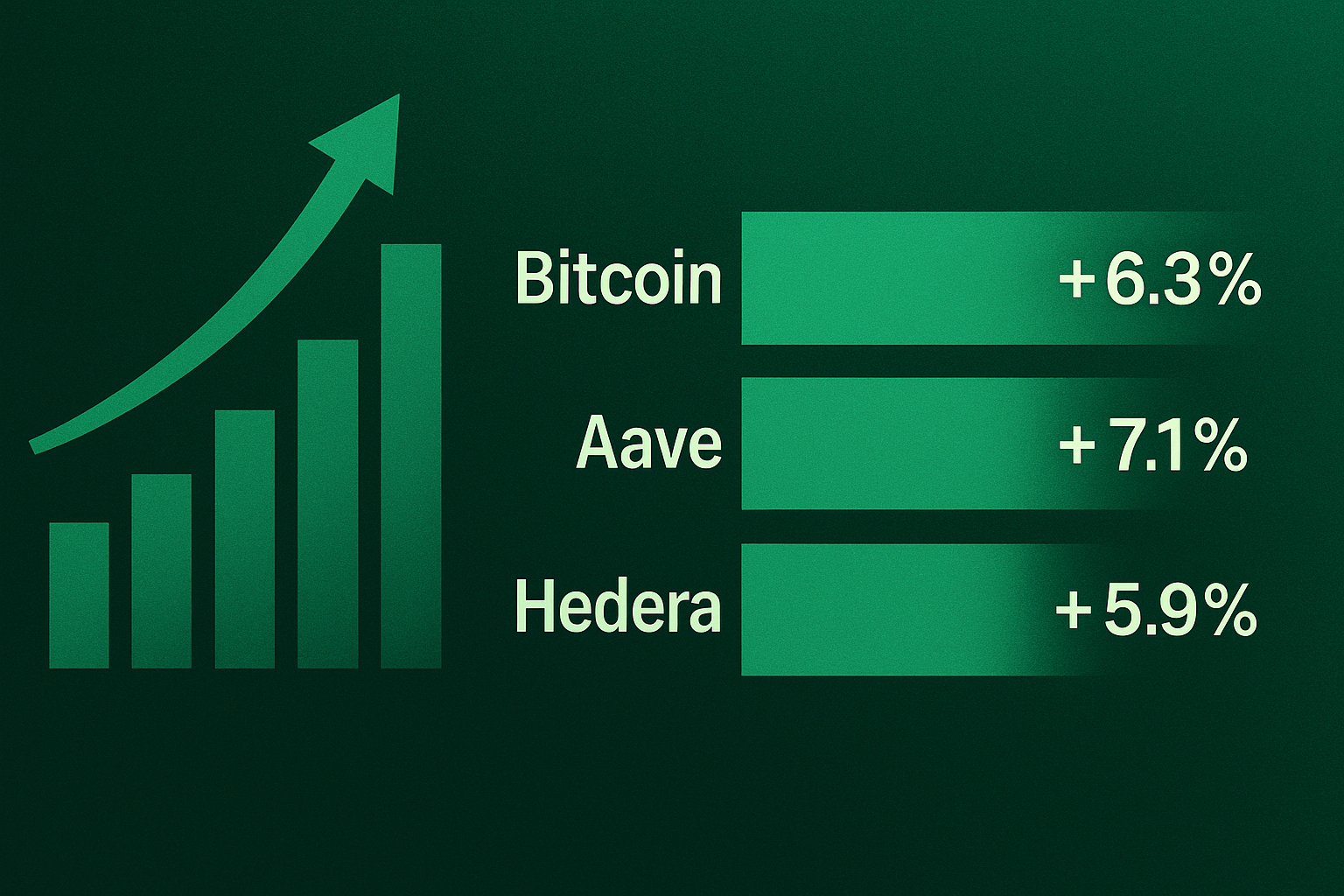

According to the freshly updated CoinDesk 20 tracker, AAVE printed a clean leg from roughly $96.80 to just north of $100.20 in less than an hour. That’s a 3.5% burst on thin Asian-session liquidity—classic «someone knows something» vibes. Hedera’s HBAR joined the mini-party with a 2.4% pop, landing at $0.062 after spending most of the week pretty much horizontal.

The combined move nudged the CoinDesk 20 index about 0.9% higher from Thursday’s close. That might sound tame, but remember: we’ve been in chop city for the past two weeks. Any green candle feels like a carnival ride right now.

Why This Matters for Your Bags

If you hold AAVE, you’re probably smiling… or at least not ugly-crying into your Ledger. Aave’s TVL has been stuck around $6.2 billion (per DeFiLlama) but the market’s clearly telling us it still respects OG DeFi protocols. We can’t ignore that Curve’s exploit and the subsequent CRV bail-out drama have traders rotating to what they see as «safer» governance tokens. AAVE feels boringly reliable compared to the adrenaline junkies chasing BASE memecoins right now.

HBAR is the wildcard. I’m not entirely sure why it caught a bid tonight—maybe front-running that rumored FedNow + Hedera integration Twitter keeps whisper-tweeting about? Could also be the Hedera Guardian news drop earlier in the week—some ESG carbon-credit angle that institutional suits love. Either way, momentum algos picked it up and did the rest.

Quick Tangent: Elon and the X-Factor

Anyone else notice Elon Musk re-tweeting random DeFi charts again? Last time he did that, DOGE went parabolic and my Uber driver was asking about “staking dog coins.” Tonight he reposted a meme about «bankers in 2030» that showed literal dinosaurs holding ledgers. Totally could be coincidence, but when AAVE spikes right after, you start connecting red-string conspiracy boards.

Data Nerd Corner (Promise, It’s Short)

CoinDesk 20 Index: 1,308.75 — up 0.9% from Thursday

AAVE 24-hour volume: $145M on Binance; $38M on Coinbase

HBAR 24-hour volume: $72M combined (Upbit is half of that—Korean degens never sleep)

Open interest in AAVE perpetuals on Bybit ticked up $12M in under 30 minutes. That’s leverage chasing a move, not starting it. Be careful—late longs can get slapped if whales decide to take profit into the FOMO.

What the Usual Suspects Are Saying

• Hasu tweeted, “Aave’s resilience post-Curve hack underscores DeFi composability when done right.”

• DeFi Dad simply posted «$100 AAVE ez»—talk about minimalism.

• Meanwhile, Cobie joked that HBAR is “the quiet kid in class suddenly winning the science fair.” Can’t lie, that nails the vibe.

So, Should You Ape In?

I can’t give you financial advice—my cat still owes me gas fees from the Pepe top—but here’s what I’m watching:

- $102.50 is previous AAVE resistance from mid-July. Flip that convincingly, and 120 bucks suddenly looks doable.

- HBAR needs daily close above $0.065 to avoid another round of «HBARbarians» meltdown memes.

- Broader macro: Tomorrow’s PCE inflation print could yank liquidity out of risk assets faster than you can say “non-core services.”

Looking Down the Road

If Aave governance finally rolls out its long-teased GHO stablecoin improvements—like dynamic interest rates—you’ll wish you bought the dip below $90. On the Hedera side, any real partnership confirmation with FedNow or Google Cloud could turn tonight’s 2.4% blip into a genuine trend reversal.

Of course, we could wake up to red candles if Asia decides to dump into EU open. Crypto never clocks out, and neither should your stop-loss strategy.

For now, enjoy the surprise green. I’m topping off my coffee and setting fresh price alerts. Call it paranoia, call it passion—either way, the charts are alive and the night is young.