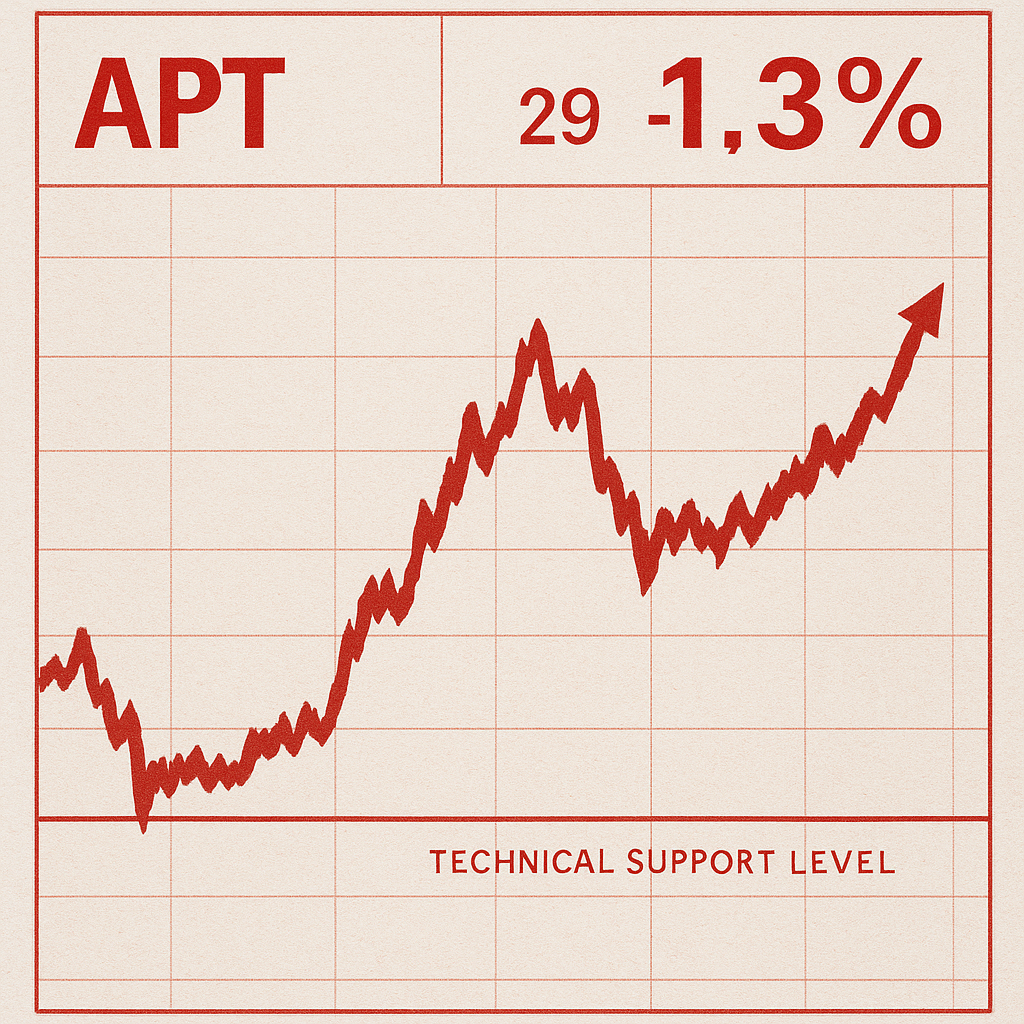

Breaking news travels fast, but crypto prices travel faster. A few hours ago, Aptos (APT) slipped a clean 4% in what felt like the blink of an eye, knifing straight through the well-worn $4.77 support zone and parking itself—almost defiantly—at $4.771. I watched the red candle print in real time on TradingView while finishing my morning espresso, and I’ll be honest: it triggered a flashback to late 2018, when coins seemed magnetically drawn toward fresh lows every other week.

Here's What Actually Happened

The raw numbers look tame on paper—4% down isn’t exactly a rug pull—but context is everything. In the last 24 hours, APT’s intraday range expanded from roughly $4.95 to $4.71, with volume spiking to about 35 million tokens (CoinMarketCap’s tally; give or take, liquidity is always foggy). That’s roughly 1.6x its seven-day average turnover, so there was genuine meat behind the move. I think some late-night Asia desk selling set off a round of cascading spot orders, and the algos happily mopped up the liquidity vacuum that followed.

If you zoom out to the four-hour chart, the price had been coiling between $5.20 and $4.90 for almost a week. The Bollinger Bands pinched tight as a drum by Tuesday afternoon, telegraphing a volatility breakout. In my experience, when bands get that narrow, you either break upward in a burst of FOMO or break downward in a quick stab. This time it was the latter. No mystery, no grand conspiracy—just pent-up energy looking for an exit.

Does This Smell Like 2017 All Over Again?

I’ve been in this racket since Mt. Gox was still solvent, and I’ve noticed that every cycle has its own set of tells. Back in the 2017 mania, altcoins would drop 5% intraday and traders would shrug, load another 3x margin play, and call it a dip buy. Post-FTX, though, sentiment is brittle. The market seems to overreact to even modest breakdowns, possibly because everyone still has PTSD from November 2022’s cliff dive.

So when I saw APT violate $4.77, I flashed back to December 2018, when Litecoin lost its $30 floor. That felt catastrophic in the moment, but by April 2019 it had tripled. I’m not saying history repeats, but it certainly rhymes—sometimes loudly.

Why $4.77 Was Important in the First Place

Technicals matter because humans put faith in round numbers and prior lows. The $4.77 line stems from a mid-September pivot—APT bounced there three different times before marching to $6.20 in early October. When a price level gets that many touches, it turns into psychological concrete. Break it once, though, and you often see a quick flush as short-term longs bail en masse.

Earlier today, I noticed the order book on Binance thinning under $4.80, with a modest buy wall near $4.70. The second that wall got eaten, the price ricocheted down to $4.71, then immediately rebounded to $4.771, where it’s now churning sideways. That looks like classic stop-run then range behavior. Market makers love to hunt liquidity, grab cheap coins, and let price drift back up so they can off-load to slower hands.

On-Chain Whispers and What the Big Wallets Are Doing

I fired up Nansen for a quick sanity check. The top ten Aptos wallets (excluding exchange cold storage) haven’t moved a meaningful chunk of coins in the last 48 hours. That tells me this was a surface-level shakeout, not a deep-state capitulation. If the whales aren’t sprinting for the exit, I’m reluctant to toss my bags overboard at fire-sale prices.

One caveat: APT’s tokenomics are notoriously front-loaded. Roughly 80 million coins still unlock over the next year, and we’ve got a big vesting wave coming December 12. I’m not entirely sure how the market will digest that. Sometimes unlocks get priced in; other times they smack you in the jaw without warning. Keep that date on your calendar, because the smartest money already has.

What Could Spark a Reversal?

In my experience, three things can flip sentiment fast:

- Macro Tailwinds: If the Fed whispers anything dovish at next week’s FOMC, risk assets—including APT—could bounce on reflex.

- Layer-1 Narrative Rotations: We saw a mini-Solana revival in Q4 2023; if funds rotate out of SOL profits, APT might snag some spillover love.

- Developer Catalyst: A juicy Aptos roadmap leak or a killer dApp launch can spark fresh demand. Remember how Sui’s testnet hype briefly lifted all Move-based boats? Same dynamic applies here.

Short term, though, the path of least resistance is sideways. The RSI on the daily sits around 39—oversold territory, but not yet screaming bear trap. If price holds above $4.70 for 48 hours, I’d wager we’ll see a mean-reversion pop back to $5.05. But if we close a daily below $4.70, the next meaningful pit stop is $4.32, which coincides with the 78.6% Fib retrace from January’s $20 peak. That’s a sobering stat, I know.

Trading Game Plan—If You Absolutely Must Touch Buttons

I’m not a financial advisor—just a crusty old trader with coffee-stained keyboards—but here’s how I’m approaching this:

- Spot stack stays put. I like averaging in under $5, so today’s price doesn’t scare me.

- Derivative play? Maybe a small 1x to 2x long with a hard stop at $4.64. Risk 1%, sleep at night.

- Alert at $5.15. If we reclaim that, I’ll consider adding, because failed breakdowns often morph into zealous rallies.

- No hero shorts. Funding rates already flipped negative (-0.03% on Bybit). Late bears may end up as exit liquidity.

Again, I might be dead wrong. The market doesn’t care about my ego, your feelings, or Jim Cramer’s latest hot take. Plan the trade, size small, and live to fight another day.

Where This Fits in the Bigger Picture

Remember when Bitcoin coughed up 50% in May 2021, dragged every alt into the abyss, and people declared the cycle dead? Six months later BTC printed new highs. I keep that memory in my back pocket every time Twitter doomers start chanting "zero." Crypto has a knack for punishing extremes—both euphoric and apocalyptic.

That said, we’re in a grindy accumulation phase. On-chain volume is down across the board, DeFi TVL sits at multiyear lows, and NFT floors look like ghost towns. Aptos isn’t immune. But I’ve lived through enough winters to know that innovation keeps simmering beneath the frost. One promising Aptos DeFi primitive or a high-profile partnership (imagine, say, a Reddit or Shopify integration) could jolt the token overnight.

So, Am I Buying, Selling, or Just Watching?

I added a nibble this afternoon, but I’m keeping powder dry. Patience has paid my rent more times than leverage ever will. In 2015 I over-traded Ethereum around $1.50, only to watch my stack evaporate in fees and bad timing. Lesson learned: let positions breathe, especially when sentiment feels fragile.

If you’re feeling FOMO because you missed yesterday’s price, breathe. If you’re feeling terror because today’s candle looks ugly, also breathe. Markets are basically mass-shared panic. Your job is to sidestep the stampede, not outrun it.

Final Thoughts—Because Crystal Balls Are Overrated

I want to sound confident, but honesty demands humility. I think APT holds the mid-$4s, chops until the next macro jolt, and maybe claws back to $6 by Q1 if the market cooperates. Yet I’ve been wrong before and I’ll be wrong again. The only certainty is volatility.

If you must anchor to something, anchor to risk management, not price predictions.

Stay nimble out there, keep one eye on the unlock schedule, and don’t forget to touch grass now and then. Your portfolio—and your sanity—will thank you.