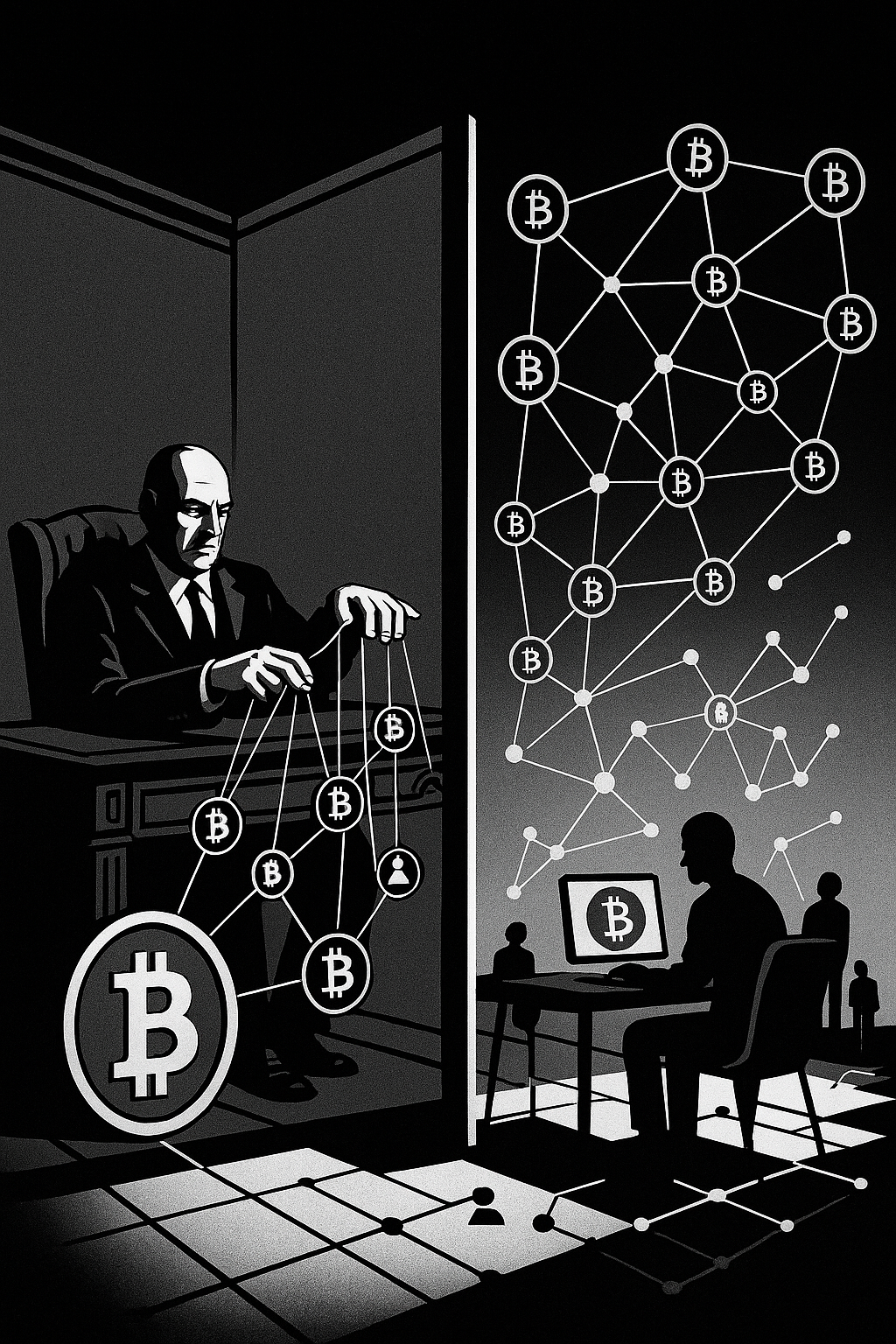

Remember When Bitcoin Was Supposed to Level the Playing Field?

Back in 2013, when I first set up my dusty little Antminer in a college dorm (and nearly fried the circuit breaker), the dream was simple: money for the people, by the people. Satoshi’s PDF promised a peer-to-peer system that could dodge Wall Street’s velvet ropes. Fast-forward a decade, and here we are staring at a Glassnode chart that says roughly 20,000 wallets now each hold at least $10 million in BTC, controlling 9.43% of the entire supply. If those numbers make you raise an eyebrow, you’re not alone — my group chat pretty much exploded when the stat dropped.

Here’s What Actually Happened

Late Monday night, on-chain sleuth @lookonchain tweeted out a screenshot showing the swelling ranks of what folks in the trenches call the “$10M Club.” According to their pull from Glassnode, around 19,760 unique addresses (give or take a few still shuffling UTXOs) now sit on balances worth eight digits or more. Cumulative stash? Just over 1.83 million BTC. For reference, that’s larger than the circulating supply of Litecoin, Doge, and ADA combined.

These aren’t just early OG miners or bag-holding exchanges. We’re talking hedge funds like Pantera, treasuries like Tesla’s, and the usual cluster of whales that flip the Bitfinex bid wall like it’s their weekend side hustle. Is that necessarily bad? Depends who you ask.

Voices From the Discord: “Centralization 2.0, Bro”

“We left the banks because they held all the chips. Are we rebuilding the same casino with pixel chips?” — @crypt0nate, r/Bitcoin moderator

That quote grabbed me because, yeah, it feels like déjà vu. I hopped into Twitter Spaces hosted by Lyn Alden last night. Her take: wallets aren’t people; some belong to custodians holding for hundreds of retail users. Fair. Yet chain analytics firm IntoTheBlock estimates about 55% of those $10M addresses are non-custodial. That’s still roughly a million BTC in the grip of a few thousand humans.

Then there’s Michael Saylor, who predictably chimed in with “Strong hands secure the network.” I get it; concentration can reduce selling pressure in bear cycles. But I’ve also watched a single whale dump 2,000 BTC on Binance and nuke a 5% rally faster than you can say “Bart pattern.”

Why This Matters for Your Stack

1. Liquidity Shock Risk: If the $10M Club colludes (or just panic-sells simultaneously), order books thin out. Remember March 12, 2020? BTC teleported from $7.9k to $3.8k in a day. Whales started it; plebs finished it.

2. Governance by Hashrate? Not Exactly: Bitcoin doesn’t do on-chain voting like UNI. But soft-fork politics (think Taproot) still rely on social consensus. Voices with fat stacks carry louder megaphones on Crypto Twitter.

3. Narrative vs. Reality: Bitcoin marketing leans on decentralization. If mainstream media catches wind that “1% of addresses own 27% of coins,” regulators like Elizabeth Warren will sharpen the anti-crypto pitchforks.

Zooming Out: Is This Really Different From the Fiat World?

Quick history detour: in 2010 the top 10% of U.S. households controlled 70% of national wealth (Fed data). By that metric, Bitcoin’s current Gini coefficient is actually less lopsided. Still, BTC was supposed to trend toward wider distribution as block rewards migrated to fees and newcomers dollar-cost-averaged using Cash App and Strike. Instead, rising prices appear to have pushed coins into the hands of those already well-capitalized — not exactly the revolution we advertised at barbecues.

But nuance matters: thanks to Taproot and batching, many small users now consolidate UTXOs; a single wallet might represent 40,000 customers at an exchange. Chainalysis pegs 18–23% of all supply in custodial pools. The data isn’t perfect.

Possible Paths Forward (Not Financial Advice, Obviously)

Self-Custody Education: The more newbies pull coins off Coinbase into Sparrow or Ledger, the harder it becomes for any whale to flex.

Layer 2 & Micro-Payments: Widespread Lightning adoption (shout-out to Strike, Breez, and Phoenix) could spread sats like confetti, boosting the number of active micro-wallets.

Proof-of-Reserves Transparency: If custodians publish Merkle tree audits, analysts can separate exchanges from genuine whale wallets, clarifying debates like the one we’re having now.

In My Experience, Perspective Helps

When I first bought BTC at $200, a single whale could crash the entire market with a 500-coin sell wall. Today it takes five digits. So yes, concentration is growing in absolute numbers, but so is liquidity. I’m not waving pompoms for inequality; I just refuse to ignore the bigger backdrop.

Also, let’s not forget that many early believers became whales by default. They should not be villainized for HODLing through a decade of FUD, hacks, and Chinese mining bans.

So, Cause for Panic or Call to Build?

I lean toward the latter. Centralization creeps in whenever value accrues — that’s human nature. The antidote isn’t rage-tweeting at rich folks; it’s onboarding more users, improving privacy (so we stop obsessing over wallet sizes), and continuing to decentralize mining via home units like the Bitaxe or FutureBit.

The $10M Club reminds us the job isn’t done. But it’s also proof that conviction still lives in this space. If those 20,000 addresses ever decide to dump, I’ll be there with limit orders because, as the saying goes, your whale’s panic is my Black Friday.

What Do We Do Next?

Keep stacking if you believe. Keep questioning if you’re unsure. And if you’re a whale reading this — DM me when you’re ready to sponsor the next round of pizza for the plebs. Let’s make sure the future of digital money actually includes everyone.