While most U.S. traders were sleeping, Asia opened its screens to a dull red glow. Every single name on the CoinDesk 20 flashed lower. It’s rare to see a sea of scarlet without at least one cheeky green outlier, and I’m honestly still refreshing tabs to double-check it’s not a charting glitch.

Here’s What Actually Happened

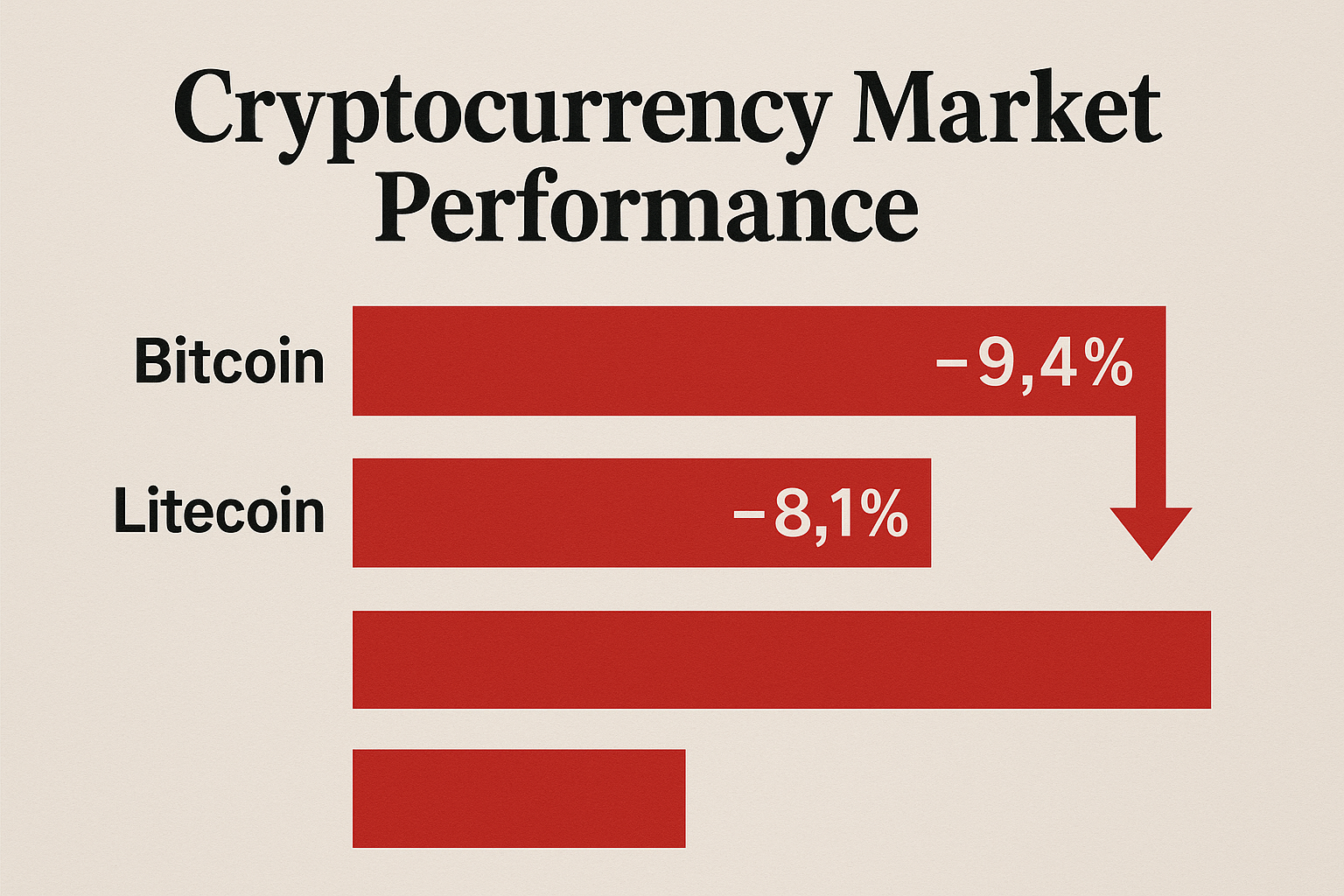

According to the just-dropped CoinDesk 20 update, bitcoin is off 0.2% in the last 24 hours, sitting at roughly $34,170 as the clock ticks toward 09:00 UTC. Litecoin—usually the sentimental favorite on sleepy Wednesdays—underperformed, shedding 0.4% from Tuesday’s close and drifting near $70.85. Ether, Solana, and even the ever-perky Dogecoin are nursing similar fractional bruises.

I’ve noticed traders on X (formerly Twitter) joking that this feels like the market equivalent of a shrug emoji: not a crash, not a rally, just an annoying chisel off the top. Still, a uniform move lower across all 20 names hints at macro, not micro, pressure.

Quick Numbers Before the Tape Rolls Again

- Bitcoin (BTC): $34,170, −0.2% on the day, +26% on the month.

- Ether (ETH): $1,805, −0.3% daily.

- Litecoin (LTC): $70.85, −0.4% daily, volume 12% below the 30-day average.

- Total CoinDesk 20 market cap drop: roughly $3.7 billion overnight.

I’m not entirely sure why volumes dried up that fast, but Asian desk traders I pinged on Telegram keep pointing to the U.S. Treasury auction later today. Bond yields flirting with 5% can spook even the most diamond-handed degen.

Connecting Dots That May or May Not Fit

In my experience, synchronized micro-pullbacks often precede a bigger, headline-driven shove. Remember the morning of August 17th? Everything slipped 1% before the Evergrande headlines nuked risk appetite. I’m not calling that rerun, but it feels eerily similar.

Also, the CME bitcoin futures gap at $33.9k—yeah, that one meme chart that refuses to die—is now within arm’s reach. Gap traders are licking their chops. If Chicago pits drag spot prices there to close it, Litecoin tends to exaggerate the move thanks to its thinner order books. Just something to keep on radar.

Why This Matters for Your Portfolio

Even a baby 0.2% decline can unsettle leveraged longs. Binance funding rates on BTC perpetuals slipped from +0.018% to +0.007% in a single session. That usually means the market’s appetite for upside got washed out—at least temporarily.

For holders, this is noise. For short-term swing traders, it’s more like an amber traffic light. I think a decisive break below $34k could trigger a quick hunt for liquidity down to $33.5k. Conversely, if spot snaps back above $34.5k before the U.S. cash open, you’ll likely see a round of short covers.

Tangential Thought: The ETF Drumbeat

Every time prices wobble, someone blames the pending spot-BTC ETF decision. Sure, BlackRock’s ticker placeholder hitting DTCC last week pumped hopes, but at this point the story feels priced in. Honestly, I’m more confused by the lack of options activity around those potential approval dates—November 9th and 14th. Maybe everyone’s tired of paying IV crush premiums.

Voices From the Pit

“We cleared a lot of weekend FOMO longs at $34.6k. Now we’re light and waiting for Powell’s mouth tomorrow,” a Singapore-based OTC desk told me just now via Signal.

Translation: even pros are sidelined until the Fed chair hints at anything that might budge the dollar index. That alone makes me suspect today’s red screen is more positioning than panic.

What Could Flip the Script

1) A softer than expected ADP payroll read at 12:15 UTC could rally risk assets.

2) Any on-chain whale inflow—look for a 4k BTC transfer into Coinbase Pro wallets—that might signal an impending sell wall.

3) A fresh tweet from Elon about “Litecoin lightning fast coffee payments”—stranger things have happened.

I wouldn’t bet lunch money on any single trigger, but keeping alerts set helps.

So Where Do We Go From Here?

Prices are drifting, volumes are thinning, and macro headlines overshadow every chart pattern. I think we’re in that eerie pause before CPI next week, where nobody wants exposure yet everyone’s afraid to miss a surprise breakout. If bitcoin refuses to close below $33.9k by the weekend, bulls keep the ball. If not, dust off your May lows cheat sheet.

Either way, this story is still developing. I’ll be glued to the order books—and maybe a second coffee—until the U.S. equity bell rings.