Breaking update, 9:15 AM UTC— If you blinked during the London open, you might've missed HYPE’s fast-and-furious wick from $34.70 to $36.80. The move lit up Telegram feeds like a Christmas tree, but the million-token question remains: can it finally flip $37 into support or are we looking at yet another bull trap?

Here's What Actually Happened Overnight

At roughly 02:00 UTC HYPE printed a clean double-bottom right on top of that psychologically sticky $32 support. We’d been talking about this level for days in the Hyperliquid Discord; plenty of us had alerts set "just in case". The bounce was textbook: the sell-off paused, open interest reset by about 7%, and funding rates went mildly negative—classic pain trade for late shorts.

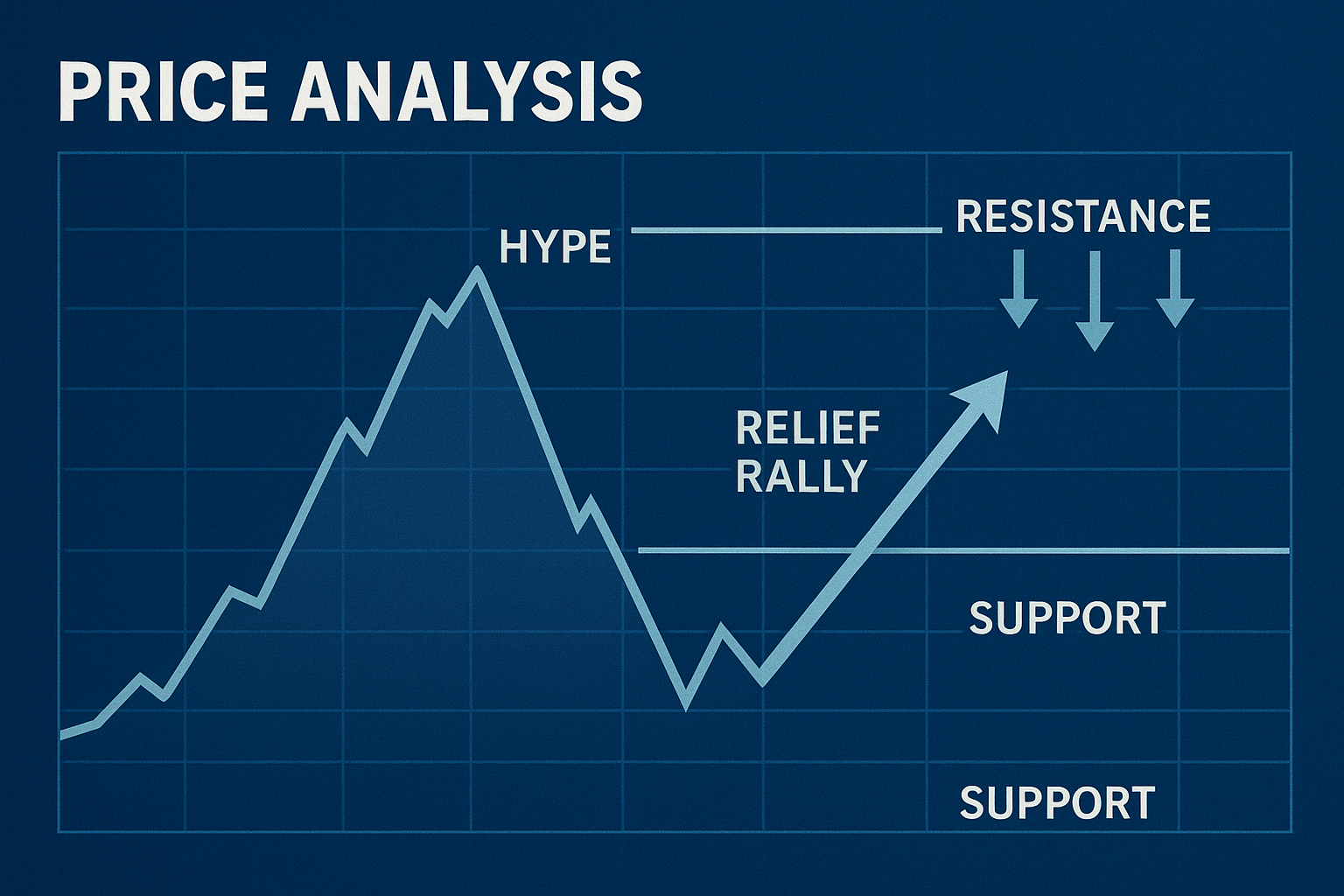

By 04:30 UTC the pair retested $35, which is technically the first support-turned-resistance now. I dropped a quick note in the group saying, “If we close a 4-hour candle above $35.50, I think the squeeze to $37 is on.” And sure enough, around the U.S. pre-market, that’s exactly what played out.

Why $37 Keeps Coming Up in Every Conversation

Let’s be real: $37 is where the February cliff started. Anyone who got rugged in that 33% drawdown still has emotional scar tissue around this level. Add in a fat cluster of December volume‐by-price nodes, and you’ve got a setup that screams, “Sell me, bro!”

“I’m not adding size until we see a daily close above $37.25—too many bagholders waiting to dump,” —@TraderDPM on X

I tend to agree. Order-book heat-maps on Hyperliquid Pro show roughly 480,000 HYPE stacked between $37 and $37.50. Until that ice thaws, bulls will need either a catalyst or a good ol’ fashioned short squeeze to bulldoze their way through.

So, What Could Possibly Provide That Catalyst?

1) Macro tailwind. Bitcoin’s flirting with $72k again after Powell’s "no surprises" FOMC presser. If BTC breaks ATH, alt liquidity normally pops like popcorn.

2) Protocol upgrade rumors. There’s chatter in the dev channel about enabling cross-margin pools by end-Q2. In my experience, platform upgrades have a knack for front-running themselves.

3) Fresh listings. Crypto.com quietly whitelisted HYPE deposits yesterday. A full spot listing could invite a new wave of retail FOMO.

But—big but—we’ve all seen altcoins shrug off bullish news when larger flows are net negative. Remember Solana’s downtime announcement last month? Price barely moved because the broader market was risk-off. Context is everything.

Where the Bears Are Aiming (and Why They’re Not Crazy)

Bears keep pointing to that daily lower-high structure since mid-March. They’ll happily short any wick into $37-$42 as long as RSI stays capped beneath 55 on the 12-hr. If you zoom out, you’ll notice the 200-day EMA is chilling right at $46, lining up with the final resistance cited in yesterday’s technical note.

“I’m selling strength until we close above the 200-day. Simple,” —JessieC, a self-proclaimed ‘permabearess’ in the Uncommon Core Telegram

I can’t fault that logic. Over the past year, HYPE has only managed two daily closes above its 200-day, and both times it fell back within a week.

Quick Detour: The Funding Rate Ping-Pong

If you’re scouting for tells, keep one eye on funding. During yesterday’s flush to $32, funding dipped to –0.012% every 8 hours, the lowest since February 6th. Fast-forward to this morning’s bounce and we’re sitting at +0.003%. That near-zero level screams “uncertainty.” In my book, flat funding + high open interest = powder keg.

What the Community Is Actually Doing With Their Bags

• Short-term swing traders—Many of us have tight stop-losses just under $34. If price nukes back below that, we’re out, no questions.

• Liquidity hunters—They’re stalking the gap between $37 and $42 for quick scalp shorts. It’s a classic resistance ladder.

• Long-term believers—A surprising chunk is dollar-cost averaging every time we kiss $32. They cite last summer’s accumulation zone as proof HYPE is still in a macro uptrend.

• Newcomers—Plenty find Hyperliquid’s order-book UI easier than dYdX’s new Cosmos chain, so there’s anecdotal “sticky” user growth brewing.

The Bigger Picture No One’s Talking About

Remember the Alameda fallout that made on-chain perpetuals all the rage? Hyperliquid’s non-custodial model piggybacks on that distrust of centralized venues. If we get even one more mid-tier exchange insolvency headline (looking at you, BitForex), capital could rotate straight into DeFi perps again. That’s when HYPE becomes more than just a trade—it turns into a narrative coin.

Of course, that’s speculation. But narratives drive markets as much as, if not more than, cold numbers. Just ask anyone who FOMOed into dog-themed coins last cycle.

Okay, So What Am I Personally Doing?

Full disclosure: I grabbed a starter bag at $33.10 with half size. My invalidation sits at $31.40—below that, I eat the loss and move on. I’ll add if we get a solid 4-hour close above $37.30 and funding stays muted. Otherwise, I’m content to stay nimble and respect the range.

Could I be wrong? Absolutely. There’s a scenario where HYPE capitulates to $28, cleans out all the leveraged bulls, then V-shapes right back. Crypto loves maximum humiliation.

Why This Matters for Your Portfolio

If you’re an altcoin junkie like me, you know most big moves start with reclaiming a prior breakdown level. That’s what $37 is for HYPE. Fail there, and capital likely rotates to hotter narratives—maybe AI coins or the latest EigenLayer LRT spin-off. Break through, and we might finally tackle that juicy $42–$46 inefficiency zone. Risk-reward suddenly looks a lot sweeter.

Bottom line: Watch $35 intraday, $37 on the daily, and $32 if things get spicy. Set alerts, grab a coffee, and don’t bet what you can’t lose. The market doesn’t care about our feelings—but the community sure does, and that collective chatter is sometimes the best early warning system we’ve got.

I’ll be live-tweeting any fireworks. Until then, trade safe and don’t forget to touch grass. 🌱