Didn’t We Learn Anything From the 2017 Discord Bot Debacle?

I’ll start with a question that’s been itching the back of my skull all week: why do we keep downloading random binaries from strangers on GitHub and then wonder where our coins went? I’m not throwing stones here—I’ve clicked plenty of shady links myself—but after a decade swimming in this shark-infested liquidity pool, you’d think the collective memory would’ve set in. Apparently not.

Here’s What Actually Happened

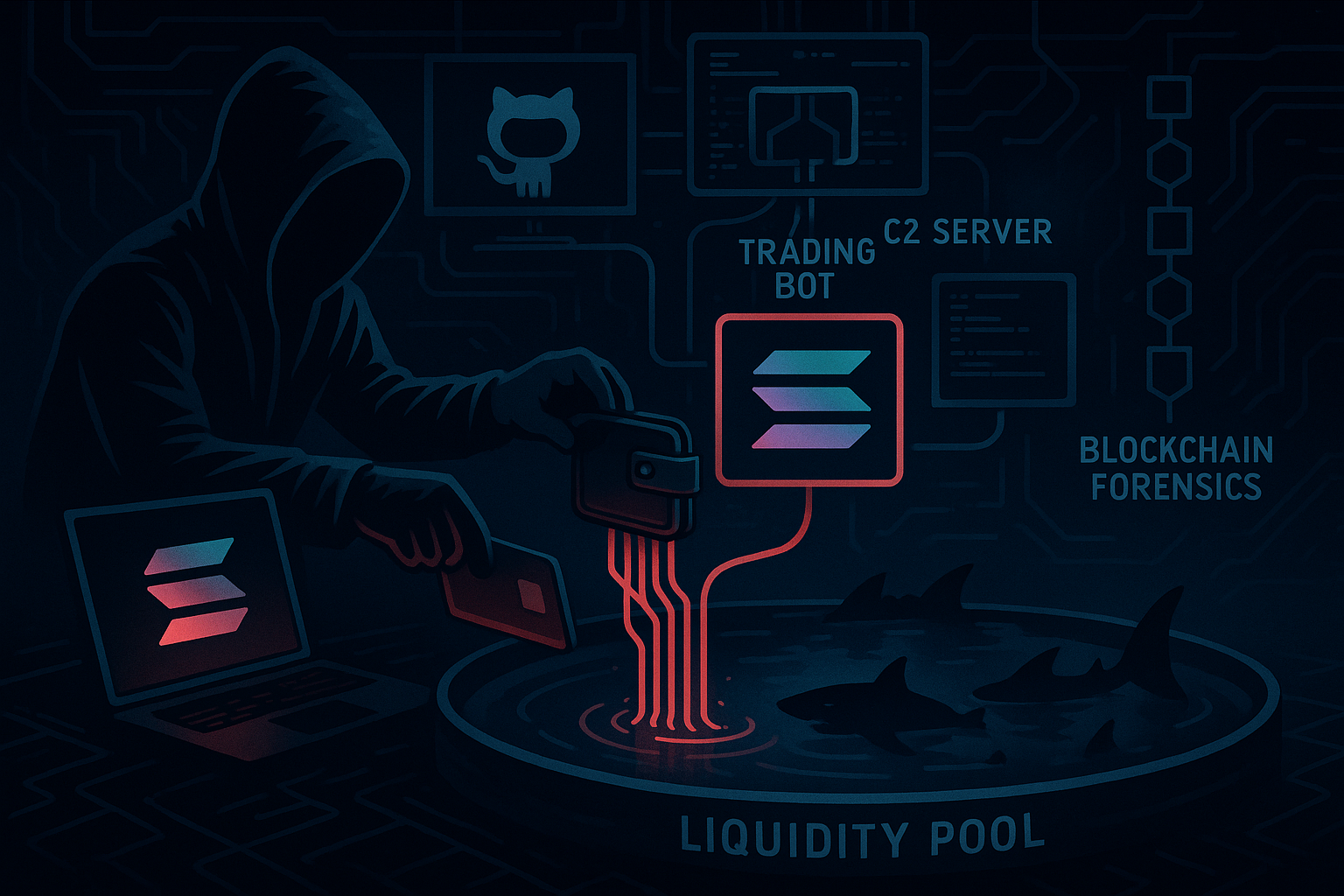

On Tuesday, the sleuths over at SlowMist flagged a repository masquerading as a high-frequency Solana trading bot. The repo promised “sub-second arbitrage across Raydium and Orca” (their words, not mine). What it really offered was a finely obfuscated bundle of malware designed to sniff out—and then siphon out—any Solana PrivateKey JSON it could find on your box.

SlowMist’s report says the malicious code pinged a C2 server every 10 seconds, exfiltrating wallet.dat files, browser autofill data, and, in some cases, entire ledger-live directories. They didn’t share the attacker’s address, but chain forensics linked at least $7,580 in SOL and assorted SPL tokens to the operation within 48 hours. That may sound small, but these things compound fast. Ask anyone who watched the Monkey Drainer saga on Ethereum last year—$7k on Monday, $7 million by Christmas.

Why the Ruse Worked (and Keeps Working)

Now here’s the interesting part: the code looked legit at first glance. I skimmed the initial commit—clean TypeScript wrappers around the Solana Web3.js SDK, real endpoint URLs, even a half-decent README. The malware payload was tucked inside a single postinstall script in package.json. If you’ve ever run npm install without scrolling through the console blur, congrats—your threat model just went up in smoke.

This trick isn’t new. Back in March 2017, I watched an “ETH-market-maker” repo pull the exact same stunt with Python and Telegram. We wrote it off as rookie season stuff then, but the stakes are higher now. Solana’s average daily volume is flirting with $1.5 billion again, and devs are hungry for edge. Free bot, promises of 12% weekly—people slam that fork button before doing a checksum.

My Little Detour on Open-Source Trust

Minor tangent: open source is still the best thing that’s happened to finance in my lifetime. But remember Linus’s famous line—“many eyes make all bugs shallow”? That only applies after the eyes actually look. In crypto, everyone’s busy YOLO-ing into airdrop strategies to audit random bot code at 3 a.m. So, yes, open source is amazing; no, it’s not foolproof.

Timeline Snapshot

- May 13, 2024 – Malicious repo goes live under a newly minted GitHub account "arbsol-pro"

- May 14 – First wallet drain reported on Solscan, roughly 190 SOL (~$28k) flagged as suspicious

- May 15 – SlowMist publishes the red-alert tweet; GitHub axes the repo within hours

- May 16 – Attacker’s address goes dormant, holding ~402 SOL and a zoo of memecoins

I’m not entirely sure if law enforcement will chase such a relatively small haul, but the on-chain breadcrumbs are there.

The Social Engineering Layer

The attacker wasn’t just banking on fat-fingered devs. They peppered Solana-themed Telegram groups with screenshots of fabricated PnL, showing a mythical 0.18 SOL profit every 90 seconds. A buddy of mine—call him Jake—actually ran the binary in a disposable VPS. The bot did spit out legit price feeds from Jupiter, which lulled him into a false sense of security, right up until the script asked for his Phantom seed “for faster swap signing.” Red flag city, but a slick UI makes people forget fundamentals faster than a 30% green candle does.

Lessons I Keep Re-Learning

1. Cold wallets are boring until they’re lifesaving. I’ll never forget September 2021 when I fat-fingered a contract call on BSC. Only reason I’m still here is most of my stack sat on a Trezor miles away from the blast radius. Same principle—if a bot wants your seed, it’s no longer a bot; it’s a burglar.

2. Checksum the hash, or the hash will checksum you. Seriously, hover over that curl | bash meme one extra time. In 2024, SHA-256 comparisons are a ten-second habit, not a novelty.

3. GitHub stars are not due diligence. This repo had 42 stars before takedown. Half the upvotes came from sock-puppet accounts created on the same day. Stars equal FOMO, not vetting.

But Isn’t Solana “Safer” Now?

I can already hear the die-hard SOL maximalists screaming, “But the network hasn’t gone down since February!” True—breakpoint era outages seem behind us. That doesn’t mean the attack surface disappeared. Remember, your endpoint is always the weakest chain link.

Phantom, Backpack, Solflare—they’ve all pushed killer updates lately: Ledger support, address-scoped approvals, and session keys. Great progress. None of that matters if you paste your seed into a random CLI prompt. No validator quorum can rescue that.

Okay, Enough Doom—How Do We Stay Ahead?

First off, verify repos like you verify contract addresses. If the maintainer joined GitHub last week and has two followers, proceed with the caution you’d reserve for a 4-week-old memecoin on Raydium.

Second, run bots in sandboxed containers—Firecracker, gVisor, whatever tickles your inner DevOps. You don’t need a CISSP to isolate file-system calls.

Third, rotate your hot wallets. I keep a 5 SOL cap per trading wallet these days. Anything above that lives behind some silicon shell that can’t talk to the internet without my thumbprint.

Quick Side Note on Reproducible Builds

I’m a huge fan of what the Nix community is doing—deterministic builds that spit the same binary every time. If this bot had been built under Nix and published with reproducible hashes, the malicious postinstall hook would’ve stuck out like a giraffe at a dog park. Food for thought for devs shipping legit trading tools.

Why This Matters for Your Portfolio

You might think, “It’s only a couple hundred wallets, I’m safe.” Maybe—but the macro-game is reputational. Every time news like this breaks, retail confidence in alt-L1s erodes. Remember when the Wormhole hack sucked $320 m out of Solana in 2022? SOL fell from $38 to $22 in a week. We’re hovering around $165 today with an eye on the psychological $200 level. A fresh headline about wallet drains can shave 10-15% off that overnight, especially in risk-off weeks when the DXY spikes.

Bottom line: security incidents are volatility catalysts. Trade accordingly—tighten stops, hedge with perp shorts, or just sit in stables until the next candles settle.

A Final Thought Before I Let You Go

“If you’re not paying for the product, you are the product.”

That line was about social media, but it maps neatly onto “free” trading bots. I love open-source as much as the next decentralization zealot, yet free code still costs something—your time, your attention, sometimes your private keys. Make sure you’re okay with the bill before clicking Install.

I wish I could say this was the last time we’ll talk about a GitHub scam stealing coins. It won’t be. But if even one of you pauses the next time a stranger offers a magic yield machine, then maybe my war stories earned their keep.

Stay paranoid out there.